ホンマゴルフBe ZEAL 535 5W

(税込) 送料込み

商品の説明

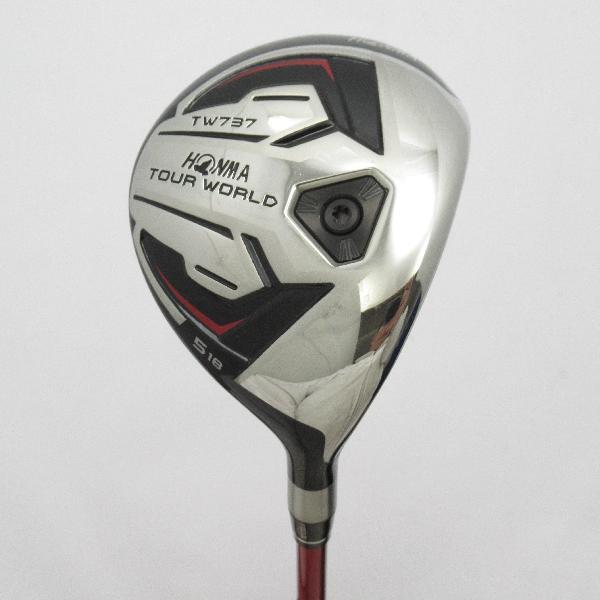

クラブ種別 フェアウェイウッド 状態(総合ランク)

ランクについてC 番手 5W 傷状態 ヘッド上部 C シャフト VIZARD for Be ZEAL(535 フェアウェイ) ヘッド下部 C メーカーフレックス R フェース C フレックス R シャフト B 発売時クラブセット組合せ内容 グリップ オリジナル 良好 本商品クラブセット組合せ内容 ヘッドカバー 純正品(普通) クラブセット実本数 0 年式 メーカーカタログ情報 お店からのコメント/商品状態

| ヘッドロフト角(°) | 18.00 | クラブ重量(g) | 311.00 |

|---|---|---|---|

| ヘッドライ角(°) | 59.50 | 利き手 | スタンダード |

| ヘッド体積(cc) | 177 | シャフト長(インチ) | 42.500 |

| 性別 | メンズ |

※メーカーカタログ情報のため、実商品と異なる場合がございます。

7135円ホンマゴルフBe ZEAL 535 5Wフェアウェイウッドホンマビジール535 U22° - 通販 - pinehotel.infoホンマゴルフ ホンマ ビジール フェアウェイウッド Be ZEAL 535 5W

ホンマゴルフ Be ZEAL 535 FW VIZARD for Be ZEAL|ホンマゴルフ

ホンマゴルフ Be ZEAL 535 FW VIZARD for Be ZEAL|ホンマゴルフ

中古 ホンマゴルフ Be ZEAL 535 フェアウェイウッド 中古

ホンマゴルフ ホンマ ビジール フェアウェイウッド Be ZEAL 535 5W

中古 ホンマゴルフ Be ZEAL 535 フェアウェイウッド 中古

ホンマゴルフ Be ZEAL 535 FW VIZARD for Be ZEAL|ホンマゴルフ

中古 ホンマゴルフ Be ZEAL 535 フェアウェイウッド 中古

ホンマゴルフ ホンマ ビジール フェアウェイウッド Be ZEAL 535 5W

ホンマゴルフ Be ZEAL 535 FW VIZARD for Be ZEAL|ホンマゴルフ

楽天市場】【中古】本間ゴルフ Be ZEAL ビジール 535 フェアウェイ

Amazon.co.jp: 【中古】本間ゴルフ Be ZEAL ビジール 535 フェアウェイ

ホンマゴルフ ホンマ ビジール フェアウェイウッド Be ZEAL 535 5W

中古 ホンマゴルフ Be ZEAL 535 フェアウェイウッド 中古

ホンマゴルフ Be ZEAL 535 FW VIZARD for Be ZEAL|ホンマゴルフ

中古 ホンマゴルフ Be ZEAL 535 フェアウェイウッド 中古

ホンマゴルフ Be ZEAL 535 FW VIZARD for Be ZEAL|ホンマゴルフ

ホンマゴルフ Be ZEAL 535 FW VIZARD for Be ZEAL|ホンマゴルフ

中古 ホンマゴルフ Be ZEAL 535 フェアウェイウッド 中古

楽天市場】中古 Cランク (フレックスSR) 本間ゴルフ Be ZEAL 535 5W

Amazon.co.jp: 【中古品】ホンマ フェアウェイウッド Be ZEAL(ビジール

中古 ホンマゴルフ Be ZEAL 535 フェアウェイウッド 中古

驚きの価格 TOUR WORLD TOUR 本間ゴルフ WORLD MP-5 シャフト:VIZARD

お気に入りの Be 本間ゴルフ ZEAL #10) #9 #8 #7 950GH(5本:#6

本間ゴルフ Be ZEAL 535 3W.5W.4U(22°) New Arrival 11270円引き www

本間ゴルフ Be ZEAL 535 フェアウェイウッド #5W [VIZARD for Be ZEAL

楽天市場】中古 Cランク (フレックスS) 本間ゴルフ Be ZEAL 535 5W

ホンマゴルフ Be ZEAL 535 5W フェアウェイウッド メンズ

中古】ビジール 535 フェアウェイウッド VIZARD for Be ZEAL 18 S D

最高級 ツアーワールド WORLD TOUR 本間ゴルフ TW737 EX-C65 シャフト

ホンマビジール535 U22° - 通販 - pinehotel.info

無料発送 ドライバーレディースホンマゴルフBe ZEAL 535ドライバー

本間ゴルフ Be ZEAL 535 フェアウェイウッド #5W [VIZARD for Be ZEAL

本間ゴルフ Be ZEAL 535 1W 10.5° VIZARD EX-A www.krzysztofbialy.com

本間ゴルフ BeZEAL(ビジール)535 フェアウェイウッドの試打レビュー

ビジール535 7W 21°-

芸能人愛用 FD-6 VIZARD フェアウェイウッド XP-1 TW WORLD TOUR WORLD

Amazon.co.jp: 【中古】本間ゴルフ Be ZEAL ビジール 535 フェアウェイ

HONMAビジール535 5FW - www.fourthquadrant.in

Be ZEAL(ビジール) 535 フェアウェイ 2018 VIZARD for Be ZEAL 5W 18 R

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています